The general stance in Russia towards Digital Currencies seems to be softening, as it had been very anti these assets. It was only just last week in Russia the Central Bank admitted that it would consider using a Cryptocurrency, backed by gold, for international settlements. Russia currently holds over $492 billion of gold which, if Digitised, some could be used to settle outstanding international debts and be a way around the economic sanctions Russia is subject to.

More and more governments are looking at Digital Currencies as a way to create more transparency, so minimising their “black economy” and, by using Smart Contracts, they could offer the potential to introduce an automatic collection of taxes - which would be faster and potentially more efficient for revenue authorities.

Interestingly, Russia has a lot to gain from embracing Digital Assets as it is a big producer of commodities. These assets typically only trade for a few hours a day and only 5 days a week. A Digital Asset pegged to different commodities could help reduce the volatility of these commodities, and provide an alternative way for Russian companies to raise capital, so getting around the aforementioned sanctions. In Germany, BSAF’s new electric car battery factory, which has been built to use commodities such as palladium and produced by Nornickel (the huge Russian commodity miner), would potentially benefit from Digital Assets. This has not been lost on Nornickel as it has been discussing with Swiss regulators the idea of establishing a digital platform to offer tokens based on palladium and nickel.

According to reports in Bloomberg, Vladimir Potanin, the Russian billionaire and CEO of Nornickle, is interested in creating new Cryptocurrency backed by palladium.

These Digital Assets could allow Nornickel to raise capital and potentially avoid sanctions.

Anything that can reduce the costs of trading in commodities has to be welcomed, and such Digital Assets could offer an interesting New Asset class for investors, as well as creating potentially greater liquidity and low commodity volatility for existing institutions.

Indeed there had been some reports, in February 2019, that Russia would develop an oil-backed Cryptocurrency.

More recently, on the back of the announcement from Facebook about its new Libra Digital currency, Russia has said that it will not legalise Libra. In an interview with local radio station Kommersant FM, Anatoly Aksakov, Chairman of the Russian State Duma Committee on Financial Markets, said “With regard to the use of Facebook cryptocurrency as a payment instrument in Russia at this stage – my opinion is that. in our country, it will be banned.”

Unfortunately, recent reports that the biggest ever hack of a Cryptocurrency exchange on Coincheck, in Japan, (where it lost $530 million in January 2018) will not endear any regulators, including Russia, to Cryptocurrencies.

Nevertheless, Russia’s Agency of Far East for Investments and Exports is reported to be looking at creating a Cryptocurrency hub in the Chinese Russian border, on an island called Bolshoy Ussuriysky. This island falls under the national border of both Russia and China! Has Bolshoy Island been chosen for...

The general stance in Russia towards Digital Currencies seems to be softening, as it had been very anti these assets. It was only just last week in Russia the Central Bank admitted that it would consider using a Cryptocurrency, backed by gold, for international settlements. Russia currently holds over $492 billion of gold which, if Digitised, some could be used to settle outstanding international debts and be a way around the economic sanctions Russia is subject to.

More and more governments are looking at Digital Currencies as a way to create more transparency, so minimising their “black economy” and, by using Smart Contracts, they could offer the potential to introduce an automatic collection of taxes - which would be faster and potentially more efficient for revenue authorities.

Interestingly, Russia has a lot to gain from embracing Digital Assets as it is a big producer of commodities. These assets typically only trade for a few hours a day and only 5 days a week. A Digital Asset pegged to different commodities could help reduce the volatility of these commodities, and provide an alternative way for Russian companies to raise capital, so getting around the aforementioned sanctions. In Germany, BSAF’s new electric car battery factory, which has been built to use commodities such as palladium and produced by Nornickel (the huge Russian commodity miner), would potentially benefit from Digital Assets. This has not been lost on Nornickel as it has been discussing with Swiss regulators the idea of establishing a digital platform to offer tokens based on palladium and nickel.

According to reports in Bloomberg, Vladimir Potanin, the Russian billionaire and CEO of Nornickle, is interested in creating new Cryptocurrency backed by palladium.

These Digital Assets could allow Nornickel to raise capital and potentially avoid sanctions.

Anything that can reduce the costs of trading in commodities has to be welcomed, and such Digital Assets could offer an interesting New Asset class for investors, as well as creating potentially greater liquidity and low commodity volatility for existing institutions.

Indeed there had been some reports, in February 2019, that Russia would develop an oil-backed Cryptocurrency.

More recently, on the back of the announcement from Facebook about its new Libra Digital currency, Russia has said that it will not legalise Libra. In an interview with local radio station Kommersant FM, Anatoly Aksakov, Chairman of the Russian State Duma Committee on Financial Markets, said “With regard to the use of Facebook cryptocurrency as a payment instrument in Russia at this stage – my opinion is that. in our country, it will be banned.”

Unfortunately, recent reports that the biggest ever hack of a Cryptocurrency exchange on Coincheck, in Japan, (where it lost $530 million in January 2018) will not endear any regulators, including Russia, to Cryptocurrencies.

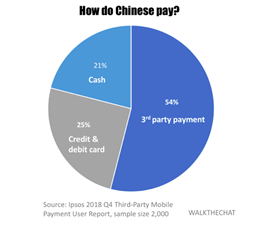

Nevertheless, Russia’s Agency of Far East for Investments and Exports is reported to be looking at creating a Cryptocurrency hub in the Chinese Russian border, on an island called Bolshoy Ussuriysky. This island falls under the national border of both Russia and China! Has Bolshoy Island been chosen for its location, as the Chinese may also be looking to see how they can use Cryptocurrencies in the Chinese economy?

The number of Digital wallets continues to grow, with Coinbase recently announcing that it now has over 30 million users on its platform - a growth of 5 million in just the last ten months!

The number of Digital wallets continues to grow, with Coinbase recently announcing that it now has over 30 million users on its platform - a growth of 5 million in just the last ten months!