Almost daily there is a report of traditional investors embracing Digital Assets.

Almost daily there is a report of traditional investors embracing Digital Assets.The CEO of Goldman Sachs, when asked if his firm is looking to launch a Digital Currency like JP Morgan, replied “Assume that all major financial institutions around the world are looking at the potential of tokenisation, stablecoins, and frictionless payments”

Meanwhile, Wall Street seasoned-investor Henry Kravis (co-founder of KKR), has been investing in Parifi Capital which has $190 billion under management, and claims he now spends most of his time researching Blockchain and Cryptocurrency opportunities. Billionaire Peter Theil (co-founder of PayPal) has, according to Blomberg, also been investing in Blockchain and Digital Assets.

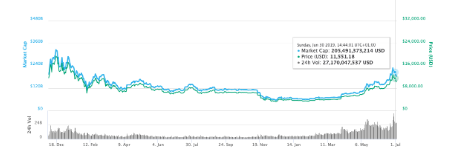

The chart shows the volume being traded in Bitcoin, and as you can see, even though the price of Bitcoin is still over 40% below the 19,454 it reached in 17th December 2017, the volume of Bitcoins being traded has been strong over the last few months.

Fidelity, with over $2.5 trillion under management, carried out a survey of 441 of its institutional clients and found that 22% had already bought a Cryptocurrency, and 47% thought that this asset class had a place in the funds it manages.

One of the concerns that have held back institutions has been that many of those that use Cryptocurrencies, like Bitcoin, are carrying out illegal activities. Therefore, in the recent analysis from Chainalysis, Bitcoin transactions have fallen in 2012 from 7% to less than 1% in 2018.

BitMex, which is the world's’ largest Crypto platform, last week reported over $16 Billion of trades in a day, demonstrating the clear demand and interest in this new asset class. Meanwhile, the Chicago Mercantile Exchange (CME) announced Bitcoin futures hit $1.7 billion in notional value traded on June 26th, 2019. This represents a 30% increase from its previous high, reportedly as a result of institutional interest.

Possibly one of the most powerful endorsements recently came from Mark Carney, Governor at the Bank of England who said, “Distributed ledger tech (DLT) projects have the potential to ‘unlock’ billions of pounds in capital and liquidity— and that they might one day see closer cooperation with the central bank itself.”