FAC is using the open-source Blockchain platform, R3’s Corda, with which FAC would appear to have very close links. The new CEO of FAC, Brian McNulty, was a former managing director at R3. One of the advisors for FAC is the founder of R3, David Rutter, formerly CEO of the electronic broking division of ICAP- the world’s biggest inter-dealer broker.

FAC, which will be based in London, claims the asset management industry is over $100 trillion. It is building a Blockchain-powered platform giving access to IFAs/distributors, transfer agents, custodians, and other intermediaries, who buy and sell units in a fund, to one common database which has military-grade security. FAC claims that for a fund manager who has £100 billion under management, its platform will save the fund manager over £30 million a year. The cost of registry, depositary, and transactions will be 0.5 basis points as opposed to the current standard 5 basis points, and FAC’s McNulty has confirmed that FAC is in discussion with 25 asset management firms ready to use its platform.

There are other companies also using Blockchain technology to reduce the costs for asset managers such as AMUN, Calstone, and Funds DLT. The potential savings of using Blockchain technology are massive, at $3.4 billion a year, according to Calstone which processes over $170 billion transactions a month.

FundsDLT was developed by Fundsquare, a subsidiary of the Luxembourg Stock Exchange, carried out its first test in 2017, and now boasts a number of fund managers using its platform including Credit Suisse, Banco Best, in Portugal, and AcomeA SGR, in Italy.

Lowering administration costs is very much a focus for fund managers as they continue to be pressurised by regulators to ensure that customers are “being treated fairly”, and because we are seeing new types of fund pricing being introduced:

zero-fee Exchange Traded Funds (ETF)

low-cost funds with performance fees.

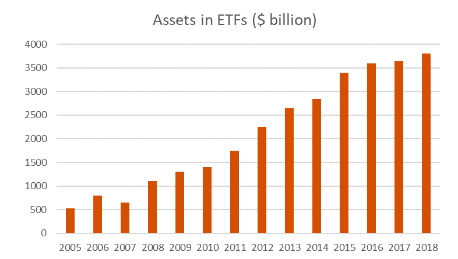

In 2019, in a report from Deloitte on the asset management sector, State Street Global Advisors’ and Investment Company Institute’s data estimated that, globally, ETFs could grow to $25 trillion by the end of 2025, up from $4.8 trillion in 2018! This growth is partly being driven by the advent of “zero-fee” ETFs, which means that asset managers have a massive incentive to crush costs as they are, in effect, subsidising some funds in order to attract additional assets under management.

Deloitte, in its report, also highlighted Allianz Global Investors have been one of the early adopters of a performance-based fee model in the United Kingdom. Investors are charged a base fee of 20 basis points and an incentive fee of 20% of any performance over the fund’s stated benchmark.

Another way that Blockchain technology is being used in the asset management sector is the tokenisation of funds, which Deloitte summarised as: “Tokenisation allows the creation of a new financial system- one that is more democratic, more efficient and vaster than anything we have seen”

Tokenisation of an existing fund enables it to be more relevant and suitable for younger fund buyers i.e. generation X and millennials, who...

FAC is using the open-source Blockchain platform, R3’s Corda, with which FAC would appear to have very close links. The new CEO of FAC, Brian McNulty, was a former managing director at R3. One of the advisors for FAC is the founder of R3, David Rutter, formerly CEO of the electronic broking division of ICAP- the world’s biggest inter-dealer broker.

FAC, which will be based in London, claims the asset management industry is over $100 trillion. It is building a Blockchain-powered platform giving access to IFAs/distributors, transfer agents, custodians, and other intermediaries, who buy and sell units in a fund, to one common database which has military-grade security. FAC claims that for a fund manager who has £100 billion under management, its platform will save the fund manager over £30 million a year. The cost of registry, depositary, and transactions will be 0.5 basis points as opposed to the current standard 5 basis points, and FAC’s McNulty has confirmed that FAC is in discussion with 25 asset management firms ready to use its platform.

There are other companies also using Blockchain technology to reduce the costs for asset managers such as AMUN, Calstone, and Funds DLT. The potential savings of using Blockchain technology are massive, at $3.4 billion a year, according to Calstone which processes over $170 billion transactions a month.

FundsDLT was developed by Fundsquare, a subsidiary of the Luxembourg Stock Exchange, carried out its first test in 2017, and now boasts a number of fund managers using its platform including Credit Suisse, Banco Best, in Portugal, and AcomeA SGR, in Italy.

Lowering administration costs is very much a focus for fund managers as they continue to be pressurised by regulators to ensure that customers are “being treated fairly”, and because we are seeing new types of fund pricing being introduced:

zero-fee Exchange Traded Funds (ETF)

low-cost funds with performance fees.

In 2019, in a report from Deloitte on the asset management sector, State Street Global Advisors’ and Investment Company Institute’s data estimated that, globally, ETFs could grow to $25 trillion by the end of 2025, up from $4.8 trillion in 2018! This growth is partly being driven by the advent of “zero-fee” ETFs, which means that asset managers have a massive incentive to crush costs as they are, in effect, subsidising some funds in order to attract additional assets under management.

Deloitte, in its report, also highlighted Allianz Global Investors have been one of the early adopters of a performance-based fee model in the United Kingdom. Investors are charged a base fee of 20 basis points and an incentive fee of 20% of any performance over the fund’s stated benchmark.

Another way that Blockchain technology is being used in the asset management sector is the tokenisation of funds, which Deloitte summarised as: “Tokenisation allows the creation of a new financial system- one that is more democratic, more efficient and vaster than anything we have seen”

Tokenisation of an existing fund enables it to be more relevant and suitable for younger fund buyers i.e. generation X and millennials, who are increasingly looking to buy and sell funds digitally on mobile devices without the need for face-to-face financial advice. Tokenisation can create more transparency, and it is possible to build-in stronger compliance monitoring due to automation-increased efficiency and lower transactions costs. This makes tokenisation of a fund a powerful incentive for asset managers to adopt.

Potentially, the additional compliance controls - using Smart Contracts – which carry out pre-authorisation checks before a fund manager trades or before a client buys a fund, coupled with greater transparency and traceability to improve KYC and AML checks, make the use of Blockchain technology highly compelling.

Ironically, it was concerns over the “dark web” and anonymity of Bitcoin - that uses Blockchain technology – that made regulators suspicious, and initially cautious, of this new Asset Class and the Blockchain technology. However, now we could well see Blockchain technology being actively encouraged to be implemented by these very same sceptics.

As The FT stated, “ Could a progressive regulator mandate a wholesale move to blockchain?”

CPRAS and the BBFTA have launched the Fairer Finance Hackathon which runs from 1-30 September to hack the poverty trap and end the debt spiral so we can help some of the neediest in society get access to fairer finance.

CPRAS and the BBFTA have launched the Fairer Finance Hackathon which runs from 1-30 September to hack the poverty trap and end the debt spiral so we can help some of the neediest in society get access to fairer finance.