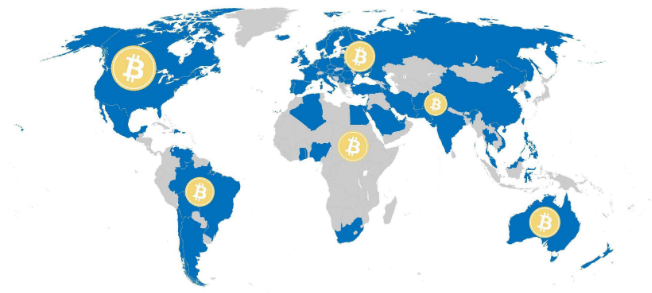

Facebook’s Libra Digital Currency would appear to have polarised those who are more receptive than others. In India and China, Libra has not had a positive reception, with both governments potentially banning Facebook’s Crypto from being used by their citizens.

There has been mixed news from the USA, with Trump tweeting “I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behaviour, including drug trade and other illegal activity....” Although also in the USA, the Federal Reserve Chairman, Jerome Powell, seemed to contradict Trump. Powell likened Bitcoin to gold, as a speculative form of value. Powell did not say Bitcoin is like gold, but how some Bitcoin’s users currently treat Bitcoin as if it were! He was stating what his thoughts were. However, it does offer a degree of legitimacy to Bitcoin’s claim to be a digital replacement for gold!

However, in the USA, there is a draft bill to try and prevent large tech firms to launch their own Cryptocurrency. The situation in the US was aptly summarised in a recent article in The Cryptoeconomist: “The current exclusive administrators of monetary policy, whether direct or indirect, do not seem to tolerate competition very well, but their reaction so far still appears to be fragmented and disorganised. However, it cannot be excluded that at some point they will be able to organise themselves and develop effective reactionary measures”

The French are less positive on Libra, with French Finance Minister, Bruno Le Maire, saying during a radio interview that Facebook’s latest foray into Cryptocurrencies “must not happen.” However, the French have confirmed that they are looking to introduce legislation so that companies, which voluntarily abide by standards on capital requirements, consumer protection and pay tax in France, will then receive approval from the regulator. Authorities in France are encouraging the European Union to create European-wide standards for Cryptocurrencies. Indeed, the French are looking at unveiling their own regulations around custody and asset management of digital assets, digital exchanges and Cryptocurrencies. In Singapore, regulators have actively tried to engage and embrace Cryptocurrencies as its Payments Service Act specifically includes Cryptocurrencies and domestic as well as cross-border transfers. In the third-biggest economy in the world (Japan), the view of its regulator the Financial Services Agency (FSA), which oversees Crypto exchanges, is that under current regulations, stablecoins are not considered to be a Cryptocurrency. Indeed, we have already seen one of Japan’s biggest banks, Mizuho, earlier this year launch a stablecoin pegged to the Yen.

The UK seems to be taking a more accommodative approach, with the FCA having pioneered the highly successful “sandbox” which allows regulated companies to, in effect, experiment and trial products and services. The soon-to-be Ex-Chancellor of the Exchequer, Phillip Hammond, confirmed that in his opinion the British government would not stand in the way of Libra.

Turkey plans to be the First Country to Issue Central Bank Cryptocurrency, according to reports from Coinape. Currently,...

Facebook’s Libra Digital Currency would appear to have polarised those who are more receptive than others. In India and China, Libra has not had a positive reception, with both governments potentially banning Facebook’s Crypto from being used by their citizens.

There has been mixed news from the USA, with Trump tweeting “I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behaviour, including drug trade and other illegal activity....” Although also in the USA, the Federal Reserve Chairman, Jerome Powell, seemed to contradict Trump. Powell likened Bitcoin to gold, as a speculative form of value. Powell did not say Bitcoin is like gold, but how some Bitcoin’s users currently treat Bitcoin as if it were! He was stating what his thoughts were. However, it does offer a degree of legitimacy to Bitcoin’s claim to be a digital replacement for gold!

However, in the USA, there is a draft bill to try and prevent large tech firms to launch their own Cryptocurrency. The situation in the US was aptly summarised in a recent article in The Cryptoeconomist: “The current exclusive administrators of monetary policy, whether direct or indirect, do not seem to tolerate competition very well, but their reaction so far still appears to be fragmented and disorganised. However, it cannot be excluded that at some point they will be able to organise themselves and develop effective reactionary measures”

The French are less positive on Libra, with French Finance Minister, Bruno Le Maire, saying during a radio interview that Facebook’s latest foray into Cryptocurrencies “must not happen.” However, the French have confirmed that they are looking to introduce legislation so that companies, which voluntarily abide by standards on capital requirements, consumer protection and pay tax in France, will then receive approval from the regulator. Authorities in France are encouraging the European Union to create European-wide standards for Cryptocurrencies. Indeed, the French are looking at unveiling their own regulations around custody and asset management of digital assets, digital exchanges and Cryptocurrencies. In Singapore, regulators have actively tried to engage and embrace Cryptocurrencies as its Payments Service Act specifically includes Cryptocurrencies and domestic as well as cross-border transfers. In the third-biggest economy in the world (Japan), the view of its regulator the Financial Services Agency (FSA), which oversees Crypto exchanges, is that under current regulations, stablecoins are not considered to be a Cryptocurrency. Indeed, we have already seen one of Japan’s biggest banks, Mizuho, earlier this year launch a stablecoin pegged to the Yen.

The UK seems to be taking a more accommodative approach, with the FCA having pioneered the highly successful “sandbox” which allows regulated companies to, in effect, experiment and trial products and services. The soon-to-be Ex-Chancellor of the Exchequer, Phillip Hammond, confirmed that in his opinion the British government would not stand in the way of Libra.

Turkey plans to be the First Country to Issue Central Bank Cryptocurrency, according to reports from Coinape. Currently, over 18% of people in Turkey own some form of Cryptocurrency, so there would seem to be reasonable interest already in this asset class.

Finally, it has been reported that “Samsung Coin” has been filed as a trademark, and while Samsung says it is not responsible, one cannot help wondering how long it will be before we see the likes of a Samsung issuing its own Cryptocurrency to pay staff, suppliers, and possibly even use it as part of a loyalty scheme for its customers?

The landscape for Cryptocurrency is getting somewhat crowded and, it will probably become more so, as other global brands launch their own currencies. It took over ten years to go from Bitcoin to a Cryptocurrency that central banks are now talking about, and which some see as a real threat to their control and influence over their economies. As the power of the US$ wains, it is highly likely that the next global currency will not come from anyone particular sovereign state, but will be digital and be backed by a selection of assets such as fiat currencies, bonds, commodities, etc, giving diversification and no undue influence or control by any one country. One of the reasons Libra has not been universally embraced is because currently it is being proposed that Libra will have a considerable allocation to the US$. Commentators are concerned that this could lead to “Dollarisation” i.e. too great a reliance on the US$ for a truly global currency.

The way Cryptocurrencies are treated by different governments varies depending on which jurisdiction you look at.

The way Cryptocurrencies are treated by different governments varies depending on which jurisdiction you look at.