Fidelity, the global asset manager which looks after over $6.7 Trillion of customers’ funds, has carried out a survey with Greenwhich, which has a database to interview of up to 3,000 institutions.

Fidelity, the global asset manager which looks after over $6.7 Trillion of customers’ funds, has carried out a survey with Greenwhich, which has a database to interview of up to 3,000 institutions. This gives Greewhich un-paralleled access to some of the world’s biggest pension, hedge, mutual and alternative managers’ insight. The survey found that 47% of institutional investors thought Digital Assets are worth investing in. The survey also found that 46 percent of respondents like the low correlation between Cryptocurrencies and other asset classes. Of the 441 institutional investors that were interviewed for this survey, between November 2018 and February 2019, 72% preferred to buy investment vehicles that hold digital assets, while 57 % chose to buy Cryptocurrencies directly. Custody continues to be a challenge for institutional managers, with 76% of the respondents saying that security is a problem, and there is a preference for well-known established custodians to offer custody services.

Amazingly, over 22% of the respondents had already invested in Digital Assets, compared to almost 0% in 2016. One suspects that we will see another substantial jump in ownership by institutions as more Security Token Offerings (STOs) come to the market, which is typically backed by “real assets”, as well as being subject to greater regulatory controls.

It is, therefore, no surprise that Andreessen Horowitz, the legendary Venture Capital firm, has generated $10 billion-plus on paper in estimated profits for its investors. Over the next year or so, no less than five of the firms it backed - Airbnb, Lyft, PagerDuty, Pinterest and Slack - are going public. Andreessen Horowitz has also been investing in Blockchain technology-related business and Cryptocurrencies, and itself has just raised over $2.7 Billion.

Another sign of institutional interest in Digital Assets can be seen by the ongoing Merger and Acquisition (M&A) activity, as this is a sign that Digital Assets, as an asset class, is beginning to mature as corporate brokers and organisations look for synergy and undervalued opportunities.

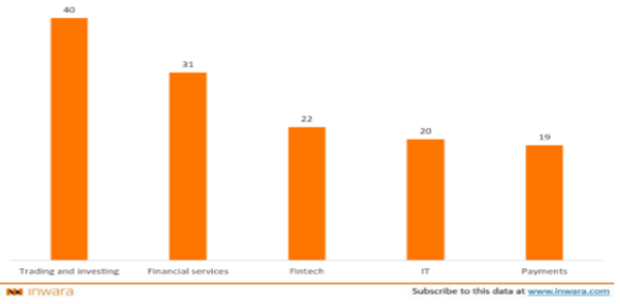

As the graph shows, M&A has been mainly focused on firms which are building the digital infrastructure i.e. exchanges and services that support them, with companies like Kraken being particularly active. So as ever, nothing changes, as it was the merchants who sold picks and shovels in the California gold rush that made money, more often than the prospectors who panned for gold itself.