In cities across the world, Blockchain technology is being used to help tackle the challenge of mountains of rubbish which we create in our throw-away culture.

In cities across the world, Blockchain technology is being used to help tackle the challenge of mountains of rubbish which we create in our throw-away culture.

For example, in Sharjah, in the United Arab Emirates, Blockchain technology is being used to create a platform designed to cut costs for customers applying for permits, from several days to only a few hours. This platform validates, processes and store transactions about Sharjah’s rubbish.

Plastic bank has been using Blockchain technology for a while to track, monitor and record various projects aimed to recycle plastic waste. As multinational-corporations, are increasingly coming under pressure from shareholders to prove that their Corporate Social Responsibility initiatives have real value, Blockchains can, and indeed are, helping. Plastic bank is working with the SC Johnson program in eight villages in Indonesia, where tokens are being given to people to encourage them to collect and recycle plastic. These tokens can then be redeemed for clothes, food, medicine and even books. So not only is SC Johnson funding an initiative to help clean the environment, but also making a real difference in remote communities.

Shell is offering bonuses to staff if they are able to suggest ways to reduce its carbon footprint. We will likely see more incentives and gamification in the form of tokens to nudge and encourage clients to change behaviour, and create less carbon emissions.

Meanwhile, in Bangalore Blockchain technology is being used to record complaints, creating a more transparent record. So when residents report and complain about rubbish, there will be a database, that cannot be tampered with, available for all to see about when and where the rubbish is reported, and follow up actions.

Initiatives using Blockchain technology like those in Indonesia and Bangalore, are not going to change the world, but will have a very positive impact on the local communities and hopefully can be replicated elsewhere.

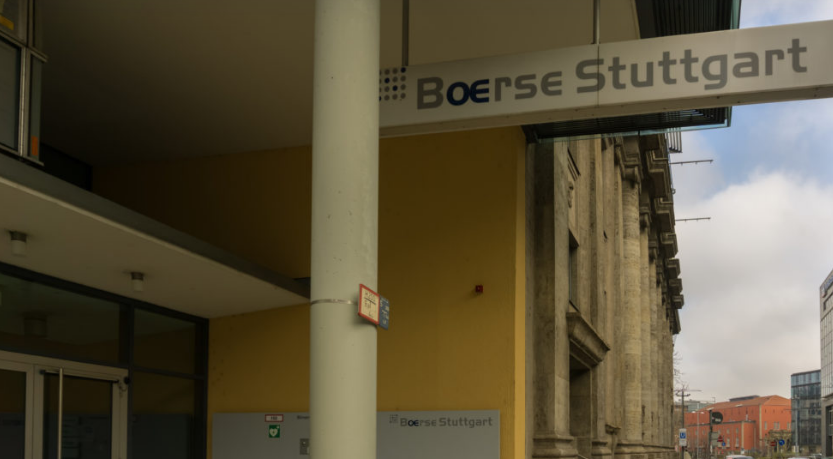

Boerse Stuttgart the German Stock Exchange, has launched its Crypto trading App, according to an official tweet dated January 31st.

Boerse Stuttgart the German Stock Exchange, has launched its Crypto trading App, according to an official tweet dated January 31st.