Last year, the European Union agreed on new prospectus regulations which will come into force on July 21st and will give clarity as to how much capital a company is able to raise when doing a securities offering in each member state.

Last year, the European Union agreed on new prospectus regulations which will come into force on July 21st and will give clarity as to how much capital a company is able to raise when doing a securities offering in each member state.

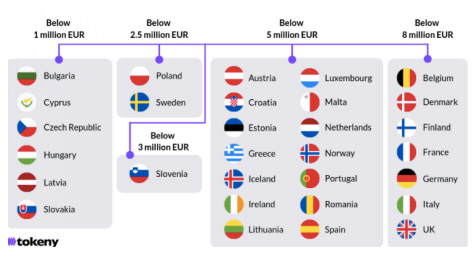

It will be possible to raise up to 8 million euros within any 12-month period from the general public, without the need for a prospectus.

The image shows the different amounts that each country will be able to raise before a prospectus is required.

This new regulation will be of great assistance to firms which intend to launch a Securities Token Offering (STO), in particular, those STOs that wish to raise a small amount of capital. STOs will also benefit as more Digital Exchanges are launched, which themselves will list these newly created securities.

Digital Asset Exchanges are where you can trade Digital Assets for others, or fiat currencies, such as £, US$, Yen CHF or Euros. If you need access to technical analysts’ tools, stop losses, profit targets, etc, then you are likely to have to open an account. However, if you just wish to make the occasional trade, there are Exchanges (often referred to as platforms) which you can use that do not require an account to be opened. There are typically three types of Digital Exchanges:

• Trading Platforms – connect buyers and sellers and take a fee from each transaction.

• Direct Trading – these platforms offer direct person to person trading where individuals from different countries can buy and sell. Direct trading exchanges don’t have a fixed market price, instead, each seller sets their own price that they wish to trade at.

• Brokers – anyone can use these to buy Digital Assets at a price set by the broker and are similar to foreign exchange brokers.

In the UK and many other jurisdictions, pension managers, mutual fund managers, and many private client portfolio managers are often restricted by their investment mandates and client agreements, to hold but only a small percentage of assets in securities that are not listed on a recognised exchange. There are many exchanges/platforms around the world that are able to trade Digital Assets - such as Coinbase, Kraken, Binance, Poloniex - and you can find a list here that gives a brief summary of ten of the better known Digital Exchanges.

It is not just new exchanges, but we are also seeing traditional exchanges entering this sector, such as the London Stock Exchange, which has recently listed UK’s first Digital Asset (2030) and has even licensed its technology to the Hong Kong Stock Exchange AAX. The world’s largest operator of Stock Exchanges, Intercontinental Exchange (ICE), is active in this space. ICE is a Fortune 500 company which owns the New York Stock Exchange (which is the world’s largest).

We have just seen new legislation being introduced in Europe, the 5th Money Laundering Directive (5MLD), which will bring it in line with the US. The 5MLD will impact Digital Assets which are involved in the provision of two different services:

• Digital Asset Exchanges – where one can buy and sell Digital Assets and traditional fiat currencies.

• Custodian Digital Wallets - firms which hold private keys

European members will now have 18 months to implement...

The image shows the different amounts that each country will be able to raise before a prospectus is required.

This new regulation will be of great assistance to firms which intend to launch a Securities Token Offering (STO), in particular, those STOs that wish to raise a small amount of capital. STOs will also benefit as more Digital Exchanges are launched, which themselves will list these newly created securities.

Digital Asset Exchanges are where you can trade Digital Assets for others, or fiat currencies, such as £, US$, Yen CHF or Euros. If you need access to technical analysts’ tools, stop losses, profit targets, etc, then you are likely to have to open an account. However, if you just wish to make the occasional trade, there are Exchanges (often referred to as platforms) which you can use that do not require an account to be opened. There are typically three types of Digital Exchanges:

• Trading Platforms – connect buyers and sellers and take a fee from each transaction.

• Direct Trading – these platforms offer direct person to person trading where individuals from different countries can buy and sell. Direct trading exchanges don’t have a fixed market price, instead, each seller sets their own price that they wish to trade at.

• Brokers – anyone can use these to buy Digital Assets at a price set by the broker and are similar to foreign exchange brokers.

In the UK and many other jurisdictions, pension managers, mutual fund managers, and many private client portfolio managers are often restricted by their investment mandates and client agreements, to hold but only a small percentage of assets in securities that are not listed on a recognised exchange. There are many exchanges/platforms around the world that are able to trade Digital Assets - such as Coinbase, Kraken, Binance, Poloniex - and you can find a list here that gives a brief summary of ten of the better known Digital Exchanges.

It is not just new exchanges, but we are also seeing traditional exchanges entering this sector, such as the London Stock Exchange, which has recently listed UK’s first Digital Asset (2030) and has even licensed its technology to the Hong Kong Stock Exchange AAX. The world’s largest operator of Stock Exchanges, Intercontinental Exchange (ICE), is active in this space. ICE is a Fortune 500 company which owns the New York Stock Exchange (which is the world’s largest).

We have just seen new legislation being introduced in Europe, the 5th Money Laundering Directive (5MLD), which will bring it in line with the US. The 5MLD will impact Digital Assets which are involved in the provision of two different services:

• Digital Asset Exchanges – where one can buy and sell Digital Assets and traditional fiat currencies.

• Custodian Digital Wallets - firms which hold private keys

European members will now have 18 months to implement...

#FrontierInsights

Capital Markets

Financial Regulation

STO