At the event, a leading barrister Jeremy Barnett spoke about how he believed Blockchain technology can add tremendous value for the owners of Real Estate.” Take as an example a new shopping centre. If all the critical information about the project was held on a Blockchain, the landlord would know at every stage during the construction of the building who had done what and why. This would create a time-stamped and immutable record which could be used for a variety of requirements -insurance, bank financing, paying contractors and even potential litigation if this were to occur at a future date. This data could even be used to help in the fractionalization/tokenization of outlets within the shopping centre, to identify who is to receive an ongoing rental income. Therefore, having “Structured data”, one can add value to an asset such as a property”.

The suitability and safety of a building is an important issue, especially in the UK, where there are potentially corporate manslaughter charges that could be bought against company directors. Company directors are potentially personally liable in the event of an accident and are at even greater risk if an employee’s life is lost while at work e.g. shop or office workers, or potentially tenants (in the case of a property company).

If data on a building is held in a structured and digitised manner, it would be possible for Smart Contracts to be used to identify when maintenance checks need to be carried out -automatically notifying when health and safety checks are required i.e. inspections on lifts, fire extinguishers, etc.

On a more sober note, the barrister Barnett said that “If such a system had been used in Grenfell Tower, we would not only know who had made critical decisions about design and materials but also it would be possible to automate many of the processes that take place, such as monitoring of fire alarms and sprinklers, to make the buildings safer. Using such a system, all those who design, build, operate and own new buildings will be able to comply with the onerous rules that will be introduced by the new Fire Safety Regulator.”

In a recent report from Harvard Business Review, which looked at How Blockchain Will Change Construction, it cited several examples of how the technology is being applied in the property sector. According to Propulsion Consulting founder Marc Minnee, who is advising on a large project in Amsterdam, “Blockchain provides a platform for clearly cascading work products down the chain and holding everyone accountable for completing key tasks,”. Meanwhile, the risk consultants at Aon, believe that 95% of building construction data currently gets lost on handover to the first owner.

Briq, a California-based Blockchain firm, is using a Blockchain-powered platform to create a “living ledger” of everything about a building - from the initial sod of earth being dug to the latest safety inspections and those potentially minimising risks for those who own and insure the property.

It is possible, in conjunction with Artificial Intelligence (AI) and Internet of Things...

At the event, a leading barrister Jeremy Barnett spoke about how he believed Blockchain technology can add tremendous value for the owners of Real Estate.” Take as an example a new shopping centre. If all the critical information about the project was held on a Blockchain, the landlord would know at every stage during the construction of the building who had done what and why. This would create a time-stamped and immutable record which could be used for a variety of requirements -insurance, bank financing, paying contractors and even potential litigation if this were to occur at a future date. This data could even be used to help in the fractionalization/tokenization of outlets within the shopping centre, to identify who is to receive an ongoing rental income. Therefore, having “Structured data”, one can add value to an asset such as a property”.

The suitability and safety of a building is an important issue, especially in the UK, where there are potentially corporate manslaughter charges that could be bought against company directors. Company directors are potentially personally liable in the event of an accident and are at even greater risk if an employee’s life is lost while at work e.g. shop or office workers, or potentially tenants (in the case of a property company).

If data on a building is held in a structured and digitised manner, it would be possible for Smart Contracts to be used to identify when maintenance checks need to be carried out -automatically notifying when health and safety checks are required i.e. inspections on lifts, fire extinguishers, etc.

On a more sober note, the barrister Barnett said that “If such a system had been used in Grenfell Tower, we would not only know who had made critical decisions about design and materials but also it would be possible to automate many of the processes that take place, such as monitoring of fire alarms and sprinklers, to make the buildings safer. Using such a system, all those who design, build, operate and own new buildings will be able to comply with the onerous rules that will be introduced by the new Fire Safety Regulator.”

In a recent report from Harvard Business Review, which looked at How Blockchain Will Change Construction, it cited several examples of how the technology is being applied in the property sector. According to Propulsion Consulting founder Marc Minnee, who is advising on a large project in Amsterdam, “Blockchain provides a platform for clearly cascading work products down the chain and holding everyone accountable for completing key tasks,”. Meanwhile, the risk consultants at Aon, believe that 95% of building construction data currently gets lost on handover to the first owner.

Briq, a California-based Blockchain firm, is using a Blockchain-powered platform to create a “living ledger” of everything about a building - from the initial sod of earth being dug to the latest safety inspections and those potentially minimising risks for those who own and insure the property.

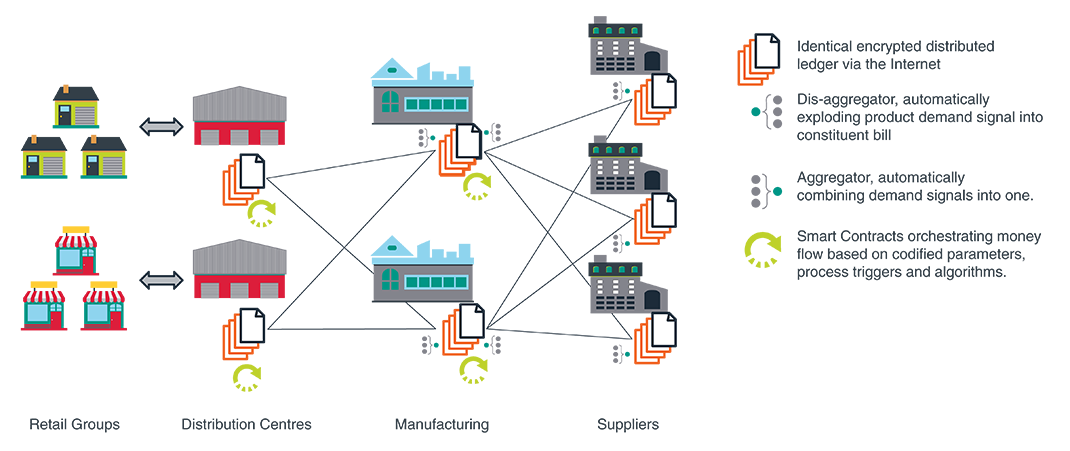

It is possible, in conjunction with Artificial Intelligence (AI) and Internet of Things (IoT), that Blockchain technology can store data in a very collaborative manner by sharing relevant data with those entities which need access to it. A combination of Blockchain, AI and IoT would be able to identify potential risks and alert relevant parties when maintenance and inspection specialists are required. This would greatly minimise potential liabilities and so reduce the costs of owning and managing Real Estate.

University College of London (UCL), which was one of the beneficiaries of Ripple’s $50 million University Blockchain Research Initiative scheme last year, recently held a conference looking at how Blockchain technology is likely to impact the construction industry.

University College of London (UCL), which was one of the beneficiaries of Ripple’s $50 million University Blockchain Research Initiative scheme last year, recently held a conference looking at how Blockchain technology is likely to impact the construction industry.