There have been many articles about how Cryptocurrencies and, in particular, Bitcoin, are an uncorrelated asset i.e. it does not ‘go up and down’ at the same time as other investments such as equities and bonds.

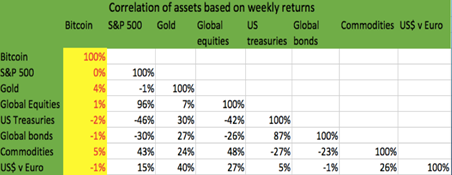

There have been many articles about how Cryptocurrencies and, in particular, Bitcoin, are an uncorrelated asset i.e. it does not ‘go up and down’ at the same time as other investments such as equities and bonds.Correlation of Bitcoin versus other asset classes

As the chart above illustrates Bitcoin has, in the past, proved to have minimal correlation with many other asset classes and so, on the face of it, could be an ideal investment to enable one ensures greater diversification in a portfolio.

Indeed, on a risk-adjusted basis by having just a small exposure of 1% to Bitcoin, it would have improved the risk-adjusted returns for an investor. Institutional investors often look at the performance of assets using something called a Sharpe ratio. In very simplistic terms the Sharpe ratio offers a way for investors to determine if they have been compensated. If they have their investment grow in value, for the amount of volatility (the degree to which the investment has gone up and down) that they experienced.