The informal/black economy means it is difficult for the Chinese government to collect the correct taxes due, it also creates inequality in society, and is thought to be one of the ways that Chinese citizens take money out of the country. "The major business for most underground banks is now contra payments, leading to huge capital outflows and great damage to society. It's the major target of our crackdown," according to a recent notice issued by China's Supreme People's Procuratorate and reported in the South China Morning Post. The black economy arguably is responsible for China being such a huge producer of counterfeit products (reportedly accounting for over 50% of all counterfeit goods manufactured globally), which often rely on cash transactions, so once again avoiding the collection of taxes.

The above illustration is calculated by Transparancy.Org (a not-for-profit organisation located in Berlin), which studies 180 countries to create the “Corruption Perception” scale. Based on the latest data, from 2017, China is ranked 77th. One of the reasons that this type of analysis is important is that foreign investors are less likely to invest in a country that has high levels of corruption. Less foreign investment leads to fewer jobs being created and slower economic growth.

In the past, while the Chinese economy was growing at 8% to 10% a year, it seemed that China turned a ‘blind eye’ to its black economy. However, as the economy slows and China’s once-massive trade surplus potentially turns to a negative, Chinese authorities are looking at ways that it can better control money in its economy.

China’s central bank, the People’s Bank of China (PBOC), has the dual mandate of maintaining price stability while promoting growth, using a selection of monetary policies. One of the ways that the PBOC is hoping it can assert greater control over its economy is by launching its Digital Currency.

China's current-account surplus has been shrinking rapidly, to less than $50 billion in 2018 from more than $300 billion in 2015, and this trend is expected to continue. After rising to nearly $60 billion in 2019, it will fall to about $20 billion in 2021, according to forecasts by the International Monetary Fund. The trade war between China and the USA shows no signs of ending. In 2018, China exported $539.5 billion worth of goods to the U.S., 4.5 times more than the U.S.’s $120.3 billion worth of shipments to China. However, China’s goods trade surplus is around $400 billion p.a., while its trade deficit in services continues to grow. Once you then add in the impact of “shopping sprees”, the United Nations World Tourism Organisation calculates that Chinese tourists overseas spent $277.3bn in 2018, compared to Americans, who only spent $144 billion! It is not difficult to see where the money is going.

In the light of the huge amounts of cash that is “sloshing around” the Chinese economy, the PBOC believes that by issuing a Digital Currency, it can hopefully take control back. The crux of the proposal is to initially replace...

The informal/black economy means it is difficult for the Chinese government to collect the correct taxes due, it also creates inequality in society, and is thought to be one of the ways that Chinese citizens take money out of the country. "The major business for most underground banks is now contra payments, leading to huge capital outflows and great damage to society. It's the major target of our crackdown," according to a recent notice issued by China's Supreme People's Procuratorate and reported in the South China Morning Post. The black economy arguably is responsible for China being such a huge producer of counterfeit products (reportedly accounting for over 50% of all counterfeit goods manufactured globally), which often rely on cash transactions, so once again avoiding the collection of taxes.

The above illustration is calculated by Transparancy.Org (a not-for-profit organisation located in Berlin), which studies 180 countries to create the “Corruption Perception” scale. Based on the latest data, from 2017, China is ranked 77th. One of the reasons that this type of analysis is important is that foreign investors are less likely to invest in a country that has high levels of corruption. Less foreign investment leads to fewer jobs being created and slower economic growth.

In the past, while the Chinese economy was growing at 8% to 10% a year, it seemed that China turned a ‘blind eye’ to its black economy. However, as the economy slows and China’s once-massive trade surplus potentially turns to a negative, Chinese authorities are looking at ways that it can better control money in its economy.

China’s central bank, the People’s Bank of China (PBOC), has the dual mandate of maintaining price stability while promoting growth, using a selection of monetary policies. One of the ways that the PBOC is hoping it can assert greater control over its economy is by launching its Digital Currency.

China's current-account surplus has been shrinking rapidly, to less than $50 billion in 2018 from more than $300 billion in 2015, and this trend is expected to continue. After rising to nearly $60 billion in 2019, it will fall to about $20 billion in 2021, according to forecasts by the International Monetary Fund. The trade war between China and the USA shows no signs of ending. In 2018, China exported $539.5 billion worth of goods to the U.S., 4.5 times more than the U.S.’s $120.3 billion worth of shipments to China. However, China’s goods trade surplus is around $400 billion p.a., while its trade deficit in services continues to grow. Once you then add in the impact of “shopping sprees”, the United Nations World Tourism Organisation calculates that Chinese tourists overseas spent $277.3bn in 2018, compared to Americans, who only spent $144 billion! It is not difficult to see where the money is going.

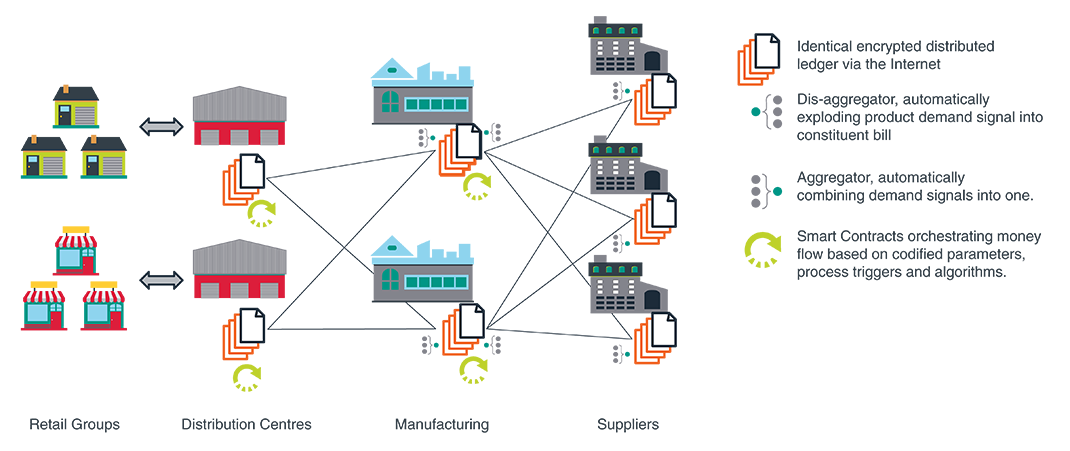

In the light of the huge amounts of cash that is “sloshing around” the Chinese economy, the PBOC believes that by issuing a Digital Currency, it can hopefully take control back. The crux of the proposal is to initially replace cash with a Digital Currency, not bank deposits. The Digital Currency is more like a stablecoin (as opposed to Bitcoin), as it will be backed up by PBOC.

It is intended that the Digital Currency will offer “controllable privacy”, which, like cash, will be able to transact without handing over personal details by being “loosely coupled” with an account. However, to minimise the risk of tax evasion and other illegal activities, the central bank will be able to view transactions.

The PBOC will be able to influence/control the Digital Currency, as outlined by Fan Vice Governor at the POBC, who said “there will be variable transaction fees, as well as daily and annual transaction limits to give the central bank more tools to control the velocity of money and its supply when interest rates cease to be a viable channel for intervention”.

It is also hoped that a Digital Currency, backed up by the PBOC and with the same legal status as a banknote will lower the cost of financial transactions, thereby helping to make financial services more widely available. This could be especially significant in China, where millions of people are still “unbanked”. A Digital Currency should also be cheaper to operate and is anticipated to reduce fraud and counterfeiting.

Given the booming Chinese online digital economy - thanks to the success of Alibaba, WeChat, etc - a Digital Currency would give the Chinese government greater control of digital transactions. From a macro-economic standpoint, such a currency would enable real-time insight, which would be enormously valuable to policymakers. And finally, it might facilitate cross-border transactions, as well as the greater use of the Renminbi outside of China, because the currency would be easier to obtain. In effect, the plan allows China’s government to use a Digital Currency to increase control, reducing the use of cash, which is virtually untraceable and can be transacted with no records.

Another reason why the PBOC wishes to have more control over the amount of cash in its economy is that we can see a global economic slowdown against a backdrop of the Chinese debt.

President Xi Jinping has not been afraid to make changes, purging members of the country’s top leadership as well as tens of thousands of low-level bureaucrats. Recently, in the fight against corruption, the Chinese government has turned its attention to China’s $1 trillion “Belt and Road” project. This ambitious project intends to connect China to Latin America, Africa and into the heart of Europe, and now China wishes to tackle corruption as it builds bridges, railways, ports and roads across some of the poorest parts of the world.

Once again, as we have heard from other governments, Digital Currencies are being seen as a way to tackle/reduce fraud and corruption in economies, cut the cost of financial transactions, embrace the unbanked and wrestle back control in the increasingly digital world.

Portugal has just announced that trading and investing in Cryptocurrencies will be free of all taxes whether, as Coinrivet says, this “simply a marketing stunt to increase crypto trades to tax them in the future, or if the Portuguese Tax Authority is trying to attract new businesses?”

Portugal has just announced that trading and investing in Cryptocurrencies will be free of all taxes whether, as Coinrivet says, this “simply a marketing stunt to increase crypto trades to tax them in the future, or if the Portuguese Tax Authority is trying to attract new businesses?”