Here is a 2-minute interview with Mark Carney, the current Governor at The Bank of England, talking about the need for new ‘World Reserve Currency’.

Here is a 2-minute interview with Mark Carney, the current Governor at The Bank of England, talking about the need for new ‘World Reserve Currency’.According to Carney, “The US economy is strong so Fed policy is to have a tighter monetary policy which isn't good for other economies, which then impacts on the US economy. Where we have three dominant economic regions - US, China and Europe - we need a new world reserve currency and it cannot be another fiat currency.”

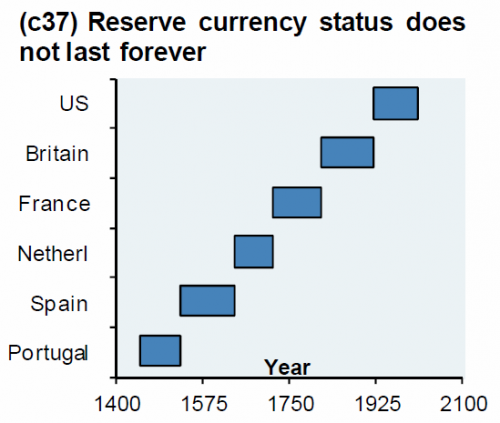

Going back to 1450, the average period a currency has been classed as the World Reserve Currency is 94 years. The US$ has held it for 94 years - how long can it continue to be so?

Instead of, for example, the new-proposed Facebook ‘Libra currency’ just being pegged to a basket of other fiat currencies, how about a global Digital Currency backed not just by the foreign exchange but stocks, commodities, bonds and property as well? In other words, a new Digital world reserve currency linked to the real assets that we use daily. Potentially would such a currency assist in reducing the volatility of the assets that make up this new Digital currency (thus reducing uncertainty for investors) and potentially helping companies make longer-term investments which help to stimulate job creation and economic growth?

It would certainly reduce the reliance on the US$. After all, in Europe and Asia why should the cost of filling up your car with fuel or heating your home in the winter be inextricably linked to the vagaries of US politics and the gyrations of the US$ - simply because the price of fuel is based in US$?

The fact that an esteemed central banker, such as Carney, is publicly proposing the end may be nigh for the mighty ‘greenback’, illustrates the potential impact Digital currencies and Blockchain technology will have on our daily lives.