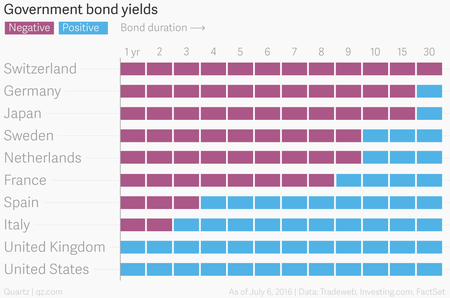

The total value of negative-yielding bonds has almost tripled since October 2018, with countries such as Switzerland, Sweden, Germany, France, the Netherlands and Japan leading the way in issuing such bonds.

Former Federal Reserve (Fed) Chairman, Alan Greenspan, recently reported to Bloomberg “nothing is stopping the U.S. from getting sucked into the global trend of negative-yielding debt. There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, besides being a certain level”. Only retiring in 2006, Greenspan was Chairman of the Fed during the 1987 crash and was in charge in the years of the debt-fuelled and derivative madness which led up to the 2008 banking crisis – he hardly has an unblemished track record.

There are more than $15 trillion bonds (see the chart below) that pay minus interest rates. Investors have to pay for the privilege of buying these bonds, as opposed to being paid to hold them.

Source: Deutsch Bank

One of the central bank’s main tools become ineffective when interest rates are very low. Savers potentially start to look for other ways to store and hold their money -maybe people just store cash under their beds. This would be a huge challenge as there is just not enough physical banknotes if savers asked for their bank deposits to be converted into banknotes. No single country has enough banknotes to enable everyone to hold cash if they wanted to.

The IMF recently wrote a report - Monetary Policy with Negative Interest Rates: Decoupling cash from Electronic Money, stating “The existence of cash prevents central banks from cutting interest rates much below zero. In this paper, we consider the practical feasibility of recent proposals for decoupling cash from electronic money to achieve a negative yield on cash which would remove the lower bound constraint on monetary policy”.

But could money in a different form i.e. Digital Currency, offer a new range of tools for governments to regain control? Maybe this is why Martin Chavez, Global co-head of securities at Goldman Sachs, recently said “I am highly confident that the Federal Reserve will one day digitize the U.S. dollar. And it will be a cryptocurrency that is the Federal Reserve issued fiat US dollar”.