In Switzerland last week, UBS told its clients that if they deposited more than €500,000 with them they would be charged 0.6% p.a. for the privilege of UBS looking after their money.

In Switzerland last week, UBS told its clients that if they deposited more than €500,000 with them they would be charged 0.6% p.a. for the privilege of UBS looking after their money.

Meanwhile in Denmark, where bond markets date back to 1787, with Jyske Bank, the country’s third-largest bank, one can get a loan for 10 years, paying no interest, and repaying only 99.5% of the loan i.e. paying back less than was initially borrowed (excluding any administration costs). Therefore, it is of little surprise that recently Danish house prices reached their highest level, beating an 11-year record.

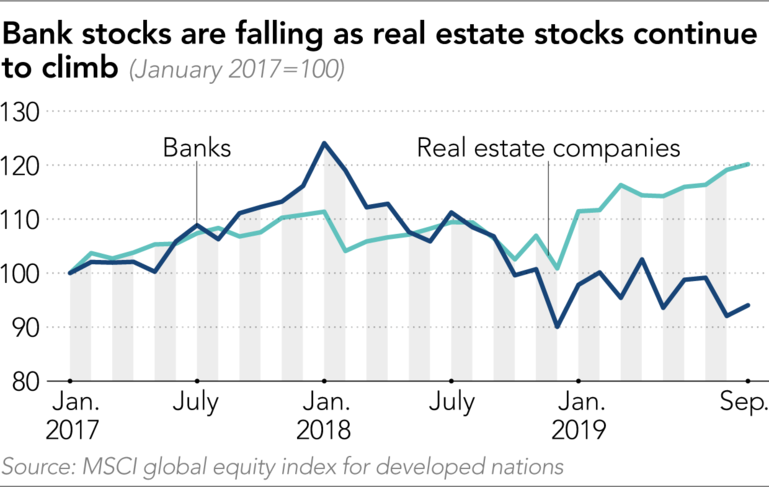

However, are stock markets trying to tell us something as, from the beginning of 2018, the total market value of banks across the globe has fallen 20%? The problem is particularly acute in Europe (which did not get the support that US banks enjoyed) as the European banks did not restructure themselves as aggressively as the US banks did following the 2008 banking crisis. In Germany, Deutsche Bank and Commerzbank estimate that negative interest rates are costing them €2.4-billion ($3.49-billion) a year (about a third of the total cost to the Eurozone banks.) After all, what will central banks and governments be able to do in the event of the next financial shock as they cannot cut interest rates very much?

The situation does not look like it is going to change any time soon with Nordea, Scandinavia's biggest bank, stating it would offer a 20-year fixed-rate mortgage with 0% interest. Bergmann, the chief analyst at Nordea's home finance unit, recently said, “It's an uncomfortable thought that there are investors who are willing to lend money for 30 years and get just 0.5% in return. It shows how scared investors are of the current situation in the financial markets, and that they expect it to take a very long time before things improve."

Current yields on 10-year sovereign bonds.

Source: The Globe and Mail (as at 6th September 2019)

If more information about the banks’ balance sheets and liabilities was held in a more ‘structured/digital’ manner using blockchain technology, it ought to be easier for regulators to carry out risk analysis and sensitivity testing of potential systemic risks. Currently, it is very difficult and time consuming to calculate the potential impact on, say, Barclays in the UK, if UniCredit (in Italy) were to have its credit rating downgraded. Smart Contracts run over Blockchain-powered platforms can be used to build in programmable compliance and regulatory controls, and thus replace many of the current analogue paper-based systems.

Quantitative easing, which started initially in Japan in 2001, and the numerous interest rate reductions have both also assisted to drive down the cost of borrowing (pumping $ trillions into the global economy), yet still, economic growth has remained anaemic. Therefore, this is fuelling more doubt on the conventional wisdom that low-interest rates are the answer to stimulate economic growth. If anything, it would seem that it has led to even greater inequality of wealth. In the UK, according to the Guardian, “The least wealthy 10% of households saw their real wealth rise by £3,000 between 2006-08 and 2012-14, versus £350,000 in gains for the wealthiest 10%”.

An unintended consequence of low, let alone, negative...

However, are stock markets trying to tell us something as, from the beginning of 2018, the total market value of banks across the globe has fallen 20%? The problem is particularly acute in Europe (which did not get the support that US banks enjoyed) as the European banks did not restructure themselves as aggressively as the US banks did following the 2008 banking crisis. In Germany, Deutsche Bank and Commerzbank estimate that negative interest rates are costing them €2.4-billion ($3.49-billion) a year (about a third of the total cost to the Eurozone banks.) After all, what will central banks and governments be able to do in the event of the next financial shock as they cannot cut interest rates very much?

The situation does not look like it is going to change any time soon with Nordea, Scandinavia's biggest bank, stating it would offer a 20-year fixed-rate mortgage with 0% interest. Bergmann, the chief analyst at Nordea's home finance unit, recently said, “It's an uncomfortable thought that there are investors who are willing to lend money for 30 years and get just 0.5% in return. It shows how scared investors are of the current situation in the financial markets, and that they expect it to take a very long time before things improve."

Current yields on 10-year sovereign bonds.

Source: The Globe and Mail (as at 6th September 2019)

If more information about the banks’ balance sheets and liabilities was held in a more ‘structured/digital’ manner using blockchain technology, it ought to be easier for regulators to carry out risk analysis and sensitivity testing of potential systemic risks. Currently, it is very difficult and time consuming to calculate the potential impact on, say, Barclays in the UK, if UniCredit (in Italy) were to have its credit rating downgraded. Smart Contracts run over Blockchain-powered platforms can be used to build in programmable compliance and regulatory controls, and thus replace many of the current analogue paper-based systems.

Quantitative easing, which started initially in Japan in 2001, and the numerous interest rate reductions have both also assisted to drive down the cost of borrowing (pumping $ trillions into the global economy), yet still, economic growth has remained anaemic. Therefore, this is fuelling more doubt on the conventional wisdom that low-interest rates are the answer to stimulate economic growth. If anything, it would seem that it has led to even greater inequality of wealth. In the UK, according to the Guardian, “The least wealthy 10% of households saw their real wealth rise by £3,000 between 2006-08 and 2012-14, versus £350,000 in gains for the wealthiest 10%”.

An unintended consequence of low, let alone, negative...

#FrontierInsights

#Bonds

#BondMarket