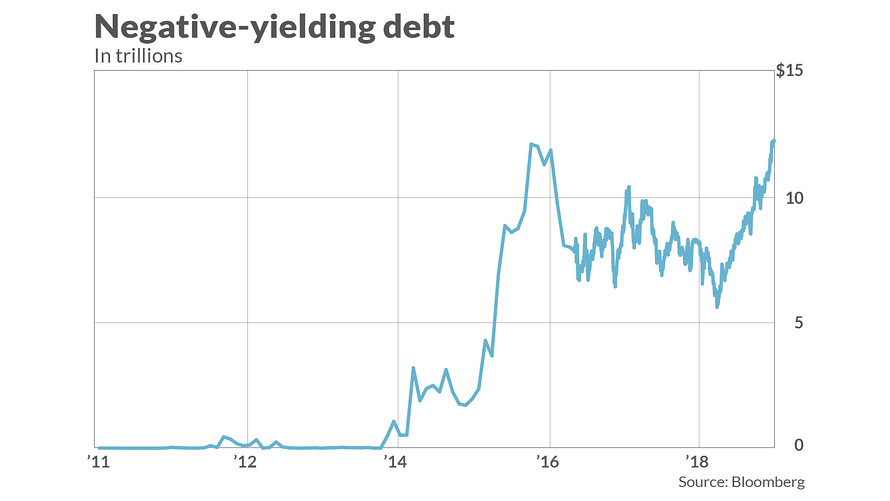

“30% of the global, tradeable bond universe is being sold - with a guaranteed loss attached to the coupon. That’s an eye-watering $US16.7 trillion”

“30% of the global, tradeable bond universe is being sold - with a guaranteed loss attached to the coupon. That’s an eye-watering $US16.7 trillion”One wonders, why some cryptocurrencies are not significantly higher than they are? There are further factors to consider:

- The US vs China trade war

- Recent local German elections vote for the far-right

- No deal BREXIT — could result in a loss of 600,000 jobs?

- Will USA default on the $1 trillion of US debt the Chinese currently?

At some stage, these debts need to be dealt with. But how?

- Default on the debt

- Pay off the debt

- Inflation to reduce the real impact of the debt mountain

To pay off the global debt by economic growth seems like a tall order to say the least, given the historic track record of the global economy in racking up debts. This leaves us with default or inflation, both of which could lead to a world recession, massive asset price volatility and, more wrongly, a huge loss in confidence. However, would this backdrop of economic chaos pave the way for a new financial order (which is less reliant on the reckless spending of governments) and quantitive easing, which has driven interest rates to almost ZERO, so fuelling this debt bonanza?

In such a crisis will we see Blockchain-powered Digital Currency backed by real assets emerge (not just other fiat currencies), which cannot be manipulated by governments and politicians, and with which the populous can both transact with and trust?