Softbank Vision fund is a massive Venture Capital fund, having participated in more than 530 funding rounds, investing over $82 billion in 200 different companies globally.

Softbank Vision fund is a massive Venture Capital fund, having participated in more than 530 funding rounds, investing over $82 billion in 200 different companies globally.It is based in Dubai, and those that have invested in Vison fund include Apple, Larry Ellison from Oracle, and the Saudi Arabian sovereign wealth fund. Softbank’s Vison fund crystallised a $7 billion profit this week, as Uber carried out its IPO, because Softbank had invested in the taxi firm a few years ago. Softbank has recently reported a profit of over $17 billion, considerably helped by its Vision fund.

This week Softbank’s Vision fund invested in two firms that are using Blockchain technology in the financial services sector, buying $900 million of Wirecard, which is a German publicly quoted company. Softbank also invested $800 million into Greensill, doubling its value compared to last year from $1.6 billion to over $3.5 billion.

This now arguably makes Greensill more valuable than Oak North, which is valued at $2.5 billion, so Greensill is now the UK's most valuable FinTech company. This is impressive given Greensill was only established in 2011!

Wirecard is a digital payments company which has been active in the Crypto payments sector, having worked with the company Crypto.com. Crypto.com is based in Hong Kong and offers Visa debit cards, which it claims are the first Crypto debit cards to be made available in Asia. Wirecard is also working with Telegram, which was one of the largest Initial Coin Offerings (ICO) to date, as it raised over $1.7 billion last year. Telegram is using Wirecard to build a digital global payments platform to create TON, which is to be Telegram’s digital token.

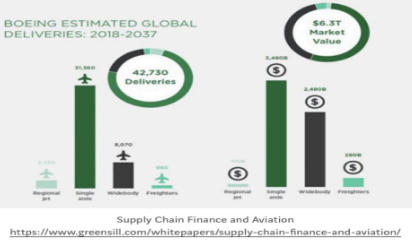

Greensill was set up in 2011, and its HQ is in the UK with offices also in the US, Germany, Australia, and South Africa. Greensill provides supply chain funding (also called working capital finance) to help companies’ cash flow. Greensill also uses Blockchain technology and sees huge potential for further growth, as it claims that over $55 trillion of cash is locked up in businesses that it aims to target.

The above graphic illustrates the types of opportunities that Greensill states are available for it to help finance. Greensill offers businesses early payment based on their invoices, due to be paid at a later date by large companies and government agencies. The payment fee to Greensill to provide financing is 1%, and Greensill is paid in full by the suppliers' customers when the invoices are settled.

However, the founder of Softbank, Masayoshi Son, despite proving to be a canny investor and making billions from holdings in Uber, Nividia, WeWork, and Flipkart, had to nurse a reportedly $130 million loss on Bitcoin. It is alleged that the Japanese billionaire Masayoshi Son bought Bitcoin when it was trading close to $20,000, and then sold his Bitcoins less than a year later when the price was closer to $5,000. So just goes to show even the best investors do not always get their timing spot on.