The World Bank cites that corruption is one of the key challenges holding back many of the poor in the world, as it can stifle investment into a country.

The World Bank cites that corruption is one of the key challenges holding back many of the poor in the world, as it can stifle investment into a country. It undermines trust in society, and it is the poor that are the most vulnerable, according to some studies, by having to pay the highest percentage of their income in bribes.

There have been success stories in the fight against corruption, such as in Afghanistan, where improvements to the management of its public finance, and making its procurement system more transparent, have helped the government save approximately $270 million.In Guinea, all of its civil servants in 2015 had to partake in a biometric identification system to eliminate fictitious or fraudulent positions, and potentially save more than $1.7 Million fraudulent salary payments.

In The Dominican Republic the “Participatory Anti-Corruption Initiative” was created, and it claimed it has helped to lower public spending by 64 percent.

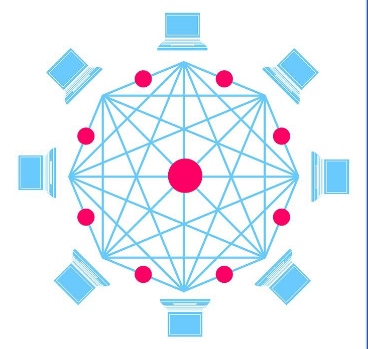

Blockchain is proving to be a useful technology that governments are increasingly using to help in this battle against fraud and corruption. The Peruvian government has recently said that it is looking to use a platform on the LAC-Chain Blockchain to register purchase orders from Peru’s Compras, a government agency that regulates electronic purchases in Peru. The LAC-Chain has been developed by the Inter-American Development Bank (IDB), which was created to promote the use of Blockchain technology in Latin America and the Caribbean. It has a network of nodes (based on Quorum) which is a Blockchain, developed by JPMorgan and is used by the JP stablecoin. It is hoped that using Blockchains will create much greater transparency and a trusted record of transactions, and so encourage additional investment into Peru while reducing bogus invoices, fraud, and corruption on at least some of the government’s spending.

In Latin America and the Caribbean, only half of adults have access to banking services. However, 90% of unbanked adults have a mobile phone. As smartphone penetration continues to grow, the popularity of virtual currencies is also growing. In Brazil, some companies and retail stores are accepting cryptocurrencies as payment. In Colombia and Argentina, more and more of their citizens are using Bitcoin as their currency of choice, due to a lack of confidence in governments and spiraling inflation rates. Venezuela has launched the Petro, a Cryptocurrency backed by its oil reserves. In the Middle East, Iran and separately, Saudi Arabia and UAE, are launching Digital currencies. All three of these countries have said one of the reasons for doing so, is to fight their countries’ “black economies”.

Ernst and Young produced a report “How Blockchain can help create better public services” last year, in which it gave numerous examples of how Blockchain technology is able to help governments globally.

The adoption of Blockchain technology by governments is important, as it is likely to encourage commercial organisations to embrace Blockchain as well. This ought to help improve peoples’ understanding about what Blockchain can offer and the good it can achieve, as opposed to associating this technology with Bitcoin and people carrying out nefarious activities in some form of anonymous manner.