Will we skip open finance and go straight to DeFi?

By Timo Lehes, co-founder of Swarm Markets

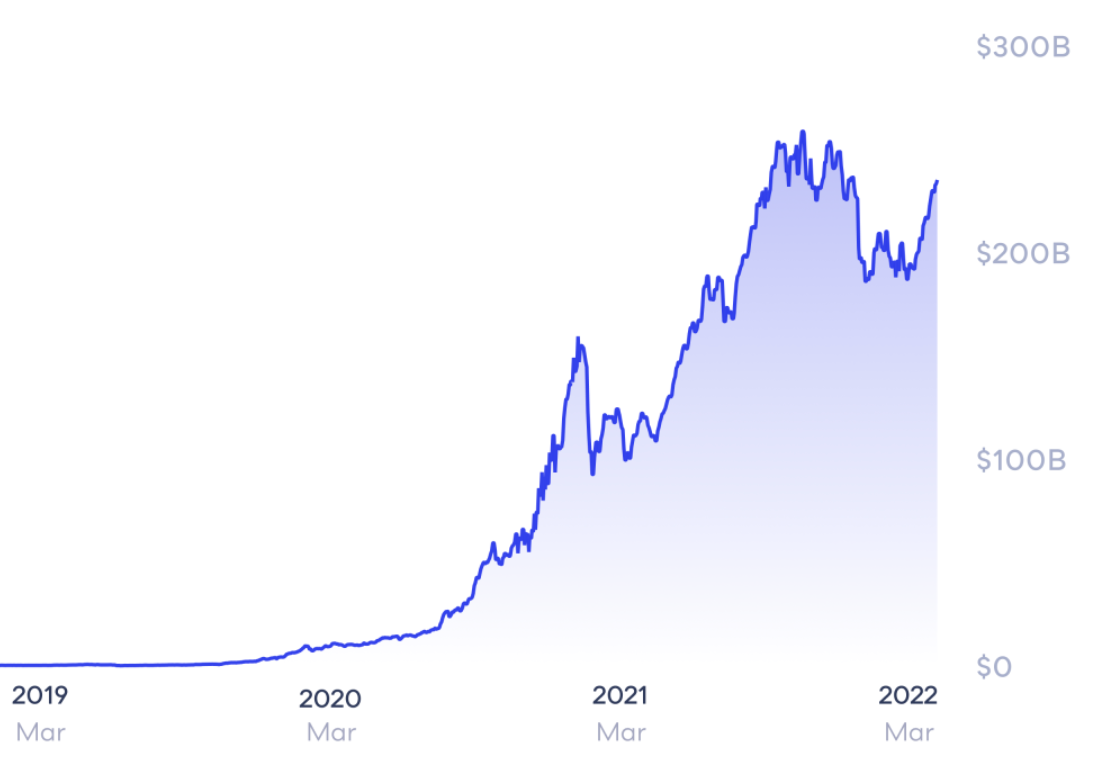

Thanks to the payment services directive (PSD2), open banking has already been mandated across Europe and the UK. The next phase of open banking is open finance, which is manifesting in industry-led initiatives and EU data policy. However, decentralised finance (DeFi) offers the openness and transparency that open finance intends to promote, meaning we could skip open finance all together and jump straight to DeFi. DeFi puts value back into the hands of those who create it. The self-custodian nature of DeFi means platforms and...

By Timo Lehes, co-founder of Swarm Markets

Thanks to the payment services directive (PSD2), open banking has already been mandated across Europe and the UK. The next phase of open banking is open finance, which is manifesting in industry-led initiatives and EU data policy. However, decentralised finance (DeFi) offers the openness and transparency that open finance intends to promote, meaning we could skip open finance all together and jump straight to DeFi. DeFi puts value back into the hands of those who create it. The self-custodian nature of DeFi means platforms and...